How Insurance Chatbots are Changing the Game

Table of Content

The insurance industry, once known for its traditional processes and paper-heavy workflows, is undergoing a significant transformation. At the forefront of this change lies the power of Artificial Intelligence (AI), specifically through the implementation of AI chatbots. These intelligent virtual assistants are revolutionizing the way insurers interact with their customers, offering a faster, more efficient, and personalized experience.

In this blog post, we’ll delve into the exciting world of AI chatbots in insurance, exploring:

- The transformative impact of chatbots on various aspects of the insurance journey, from sales and onboarding to claims processing and customer support.

- Real-world examples of how leading insurance companies are leveraging AI chatbots to enhance customer engagement and streamline operations.

- The future potential of AI chatbots in the insurance landscape, including advanced functionalities and anticipated benefits for both insurers and policyholders.

So, buckle up and get ready to discover how AI chatbots are redefining the future of insurance!

How to Transform Customer Experience in Insurance

Navigating complex insurance plans, filing claims, and understanding policy benefits can often feel like a daunting labyrinth. Customers struggle with complex websites and technical jargon, leading to confusion and frustration.

Insurance companies recognize the need for a seamless and intuitive customer experience. Enter AI chatbots, emerging as a powerful tool for revolutionizing customer interactions. Nearly 80% of insurance executives believe AI will transform how they engage with customers, and chatbots are at the forefront of this AI revolution.

The Evolving Demands of today’s Customers

Today’s insurance customers expect instant, personalized service across all channels. Static policies and impersonal interactions are a thing of the past. They want flexibility, transparency, and proactive solutions.

How can insurers meet these demands?

- Embrace digital: Data and technology unlock tailored experiences.

- Omnichannel engagement: Seamless interactions across platforms keep customers happy.

- Self-service options: Empower customers with control and convenience.

- AI-powered solutions: Chatbots provide instant support and gather valuable data.

By prioritizing customer experience and leveraging AI, insurers can bridge the gap and thrive in a competitive market.

Bonus: Chatbots not only enhance satisfaction, but also gather valuable customer data, helping insurers attract new customers.

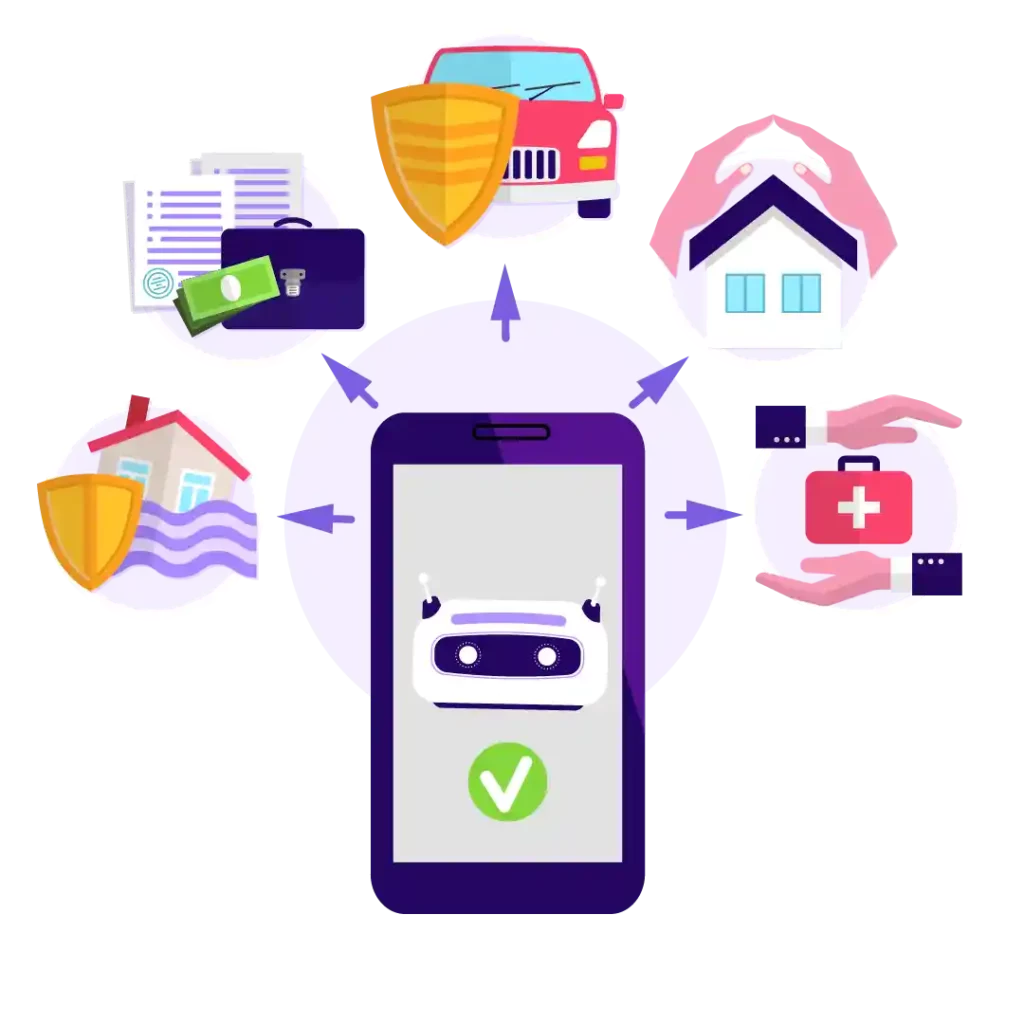

Chatbots for Insurance: A Comprehensive Guide to Use Cases

1. Streamline Customer Service: Chatbots can answer FAQs, troubleshoot common issues, and direct customers to the appropriate resources, freeing up human agents for complex inquiries.

2. Enhance Policy Management: Enable customers to access policy details, update information, and make payments through the chatbot, offering 24/7 self-service options.

3. Personalize the Experience: Integrate chatbots with CRM systems to personalize interactions, addressing customers by name and offering relevant recommendations based on their policy and past inquiries.

4. Facilitate Claims Processing: Guide customers through the claims process, gather initial information, and answer basic questions, expediting claim resolution and reducing processing time.

5. Provide Risk Management Tips: Offer proactive guidance on risk mitigation strategies and safety measures, promoting customer engagement and reducing potential claims.

6. Collect Customer Feedback: Utilize chatbots to gather feedback on customer experience, product offerings, and overall satisfaction, informing continuous improvement efforts.

7. Automate Marketing and Sales: Chatbots can qualify leads, answer product inquiries, and even generate personalized quotes, streamlining the sales process and nurturing potential customers.

8. Offer Multilingual Support: Cater to a wider audience by enabling chatbots to communicate in multiple languages, ensuring accessibility and inclusivity for diverse customer bases.

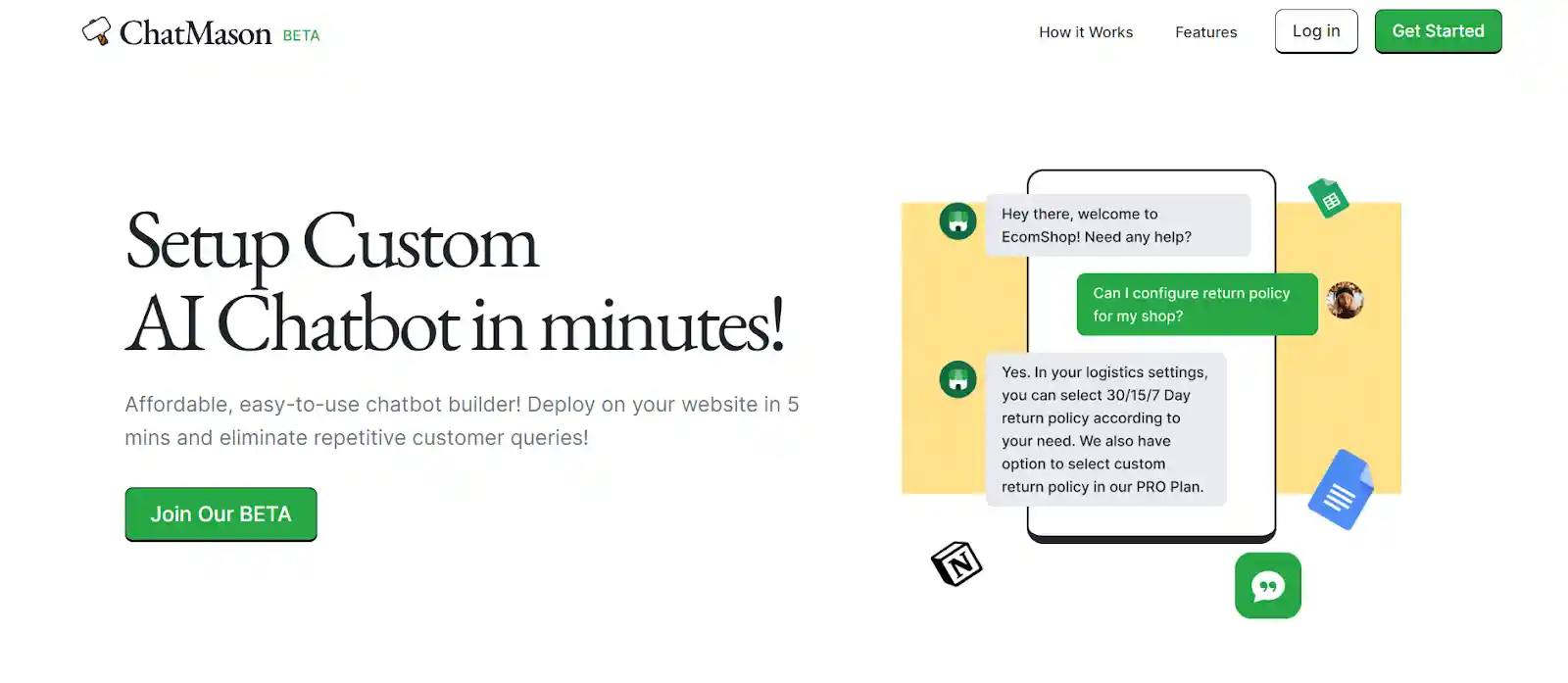

By implementing these strategies and leveraging a flexible platform like Chatmason.ai, insurance companies can unlock the full potential of chatbots to enhance customer experience, optimize operations, and drive growth in the ever-evolving insurance landscape.

Unveiling the Benefits of Insurance Chatbots

Forget the stacks of paperwork, insurance is getting a digital makeover! AI chatbots are leading the charge, transforming how insurers interact with customers.

These virtual assistants offer a faster, smoother, and more personalized experience for everyone.Let’s explore how AI chatbots benefit both insurers and policyholders!

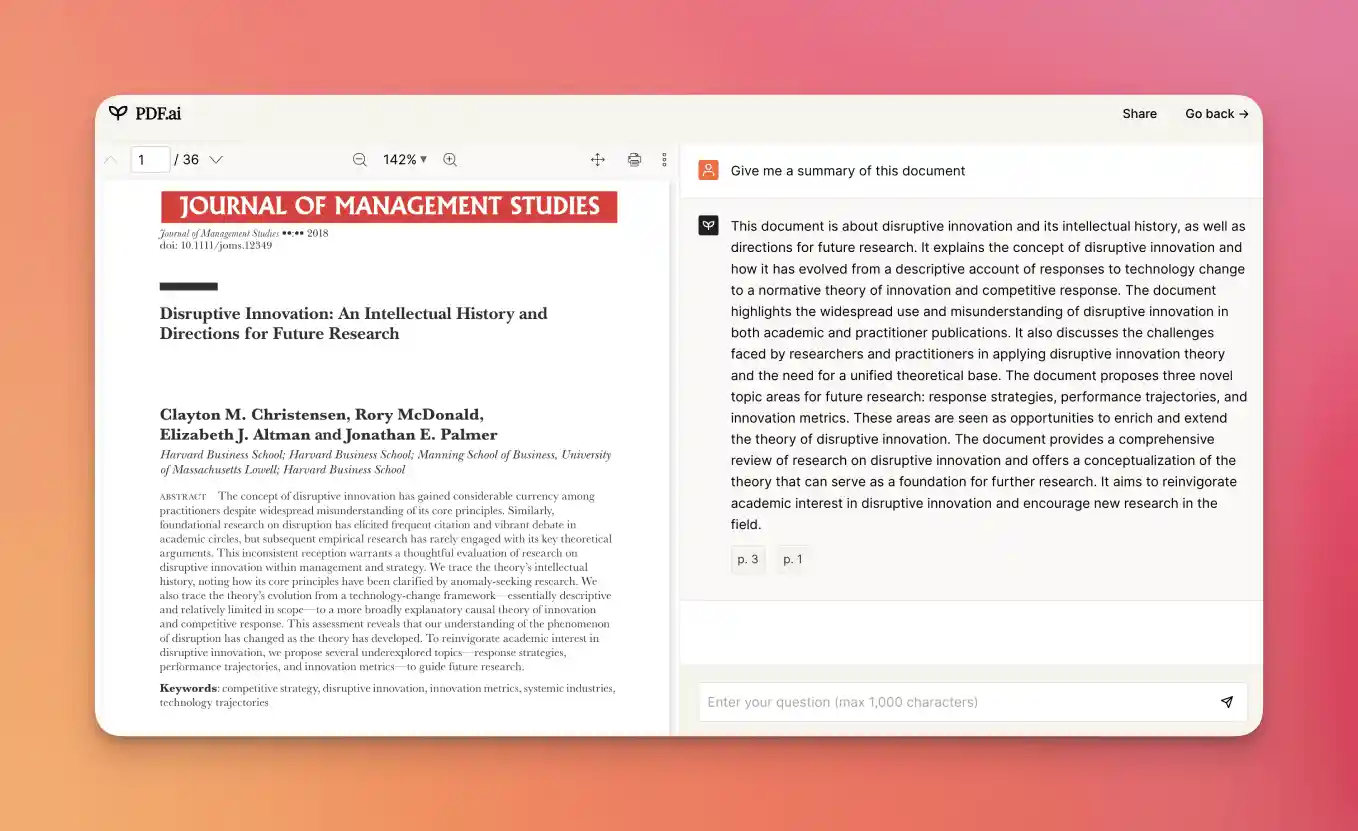

Educating Customers to make Informed Insurance Decisions

- Simplify complex info: Break down jargon and explain coverage details in clear language.

- Interactive guidance: Help customers choose the right plan with personalized recommendations.

- Time-saving comparisons: Show side-by-side analyses of different plans for easy decisions.

- Knowledge hub: Provide access to educational resources for a deeper understanding.

Lead profiling and conversion

- Qualify leads smarter: Chatbots ask targeted questions to understand needs and prioritize high-quality leads.

- Personalize the experience: They address leads by name, recommend relevant options, and tailor information.

- 24/7 availability: Never miss a lead – chatbots answer questions and nurture leads around the clock.

- Frictionless data collection: Gather valuable data seamlessly throughout the conversation.

- Streamline quotes: Collect essential information and tailor quotes for faster conversion.

Chatbots are the game-changers insurance needs to win in a competitive market.

Achieve Faster Claim Resolution and Timely payment assistance

- Faster Resolution: Get immediate help filing claims and receive initial guidance anytime, anywhere.

- Simplified Process: Chatbots guide you through a clear and easy claim initiation process.

- Reduced Errors: Skip the back-and-forth and ensure all necessary information is collected efficiently.

- 24/7 Support: Get answers to payment questions and track claim progress around the clock.

- Empowered Policyholders: Take control of your claim and make informed decisions with readily available information.

Future of Chatbot Implementation in Insurance

The impact of AI chatbots in the insurance industry is undeniable, and their influence is projected to grow significantly in the years to come. As we look towards the future, several key trends are shaping the evolution of insurance chatbots:

Expanding Beyond Customer Service

While currently excelling in tasks like answering FAQs and troubleshooting common issues, chatbots are expected to shoulder more complex responsibilities. This includes automating processes such as fraud detection, policy underwriting, and risk assessment. By leveraging advanced algorithms and data analysis capabilities, chatbots will improve efficiency and accuracy in these critical areas.

Enhanced Human-like Interactions

Advancements in technologies like Natural Language Processing (NLP), machine learning, and sentiment analysis will pave the way for more natural and engaging chatbot interactions. This will result in personalized conversations that cater to individual needs and preferences, ultimately fostering stronger customer relationships and improved user experiences.

Omnichannel Customer Engagement

The future envisions a seamless integration of chatbots across various platforms, offering a truly omnichannel customer experience. Whether it’s social media, mobile apps, or the company website, customers will encounter a consistent and unified AI chatbot service, ensuring convenient and accessible support regardless of the chosen channel.

Bolstered Fraud Detection Capabilities

Chatbots hold immense potential for enhancing insurance fraud detection. By harnessing the power of data analytics, machine learning, and pattern recognition, AI bots will be able to identify suspicious activities or inconsistencies in claims with greater accuracy compared to traditional methods. This will strengthen the overall insurance ecosystem by mitigating fraudulent activities and protecting both insurers and policyholders.

In conclusion, the future of insurance chatbots is brimming with possibilities. As these intelligent virtual assistants continue to evolve, they are poised to revolutionize the insurance landscape. This will ultimately lead to a more efficient, secure, and customer-centric insurance industry for all stakeholders.

Select a platform like Chatmason.ai that empowers customization and future growth. This ensures your chatbot can adapt to evolving needs, integrate seamlessly with existing systems, and scale alongside your business.

FAQs

- Can AI chatbots handle complex insurance claims?

- While chatbots can handle a wide range of claim types, some more intricate situations might still require human interaction. However, chatbots can efficiently gather initial information, streamline the process, and connect you with the right agent for your specific needs.

- Will AI chatbots replace insurance agents entirely?

- No, chatbots are more likely to work alongside agents, not replace them. Chatbots excel at handling routine tasks and providing 24/7 support, freeing up agents to focus on complex claims and personalized customer service.

- Are AI chatbots secure for my personal information?

- Reputable insurance companies prioritize data security. Look for providers that emphasize secure chatbots with strong encryption protocols to protect your sensitive information.

- How can I get started using an AI chatbot for my insurance needs?

- Many insurance companies offer chatbot services directly on their websites or mobile apps. Look for a dedicated “chat” or “virtual assistant” section to initiate a conversation with the AI chatbot.