How Financial Chatbots Are Revolutionizing Banking

Table of Content

The banking industry is changing fast! Banks are looking for new ways to keep customers happy and make things run smoother. Enter financial chatbots – AI-powered virtual assistants that are transforming how banks interact with you. These chatbots offer a perfect mix of convenience, personalization, and efficiency, making banking a whole lot easier.

Exploring Financial Chatbots

Financial chatbots are like having a smart friend at the bank, available 24/7! These cutting-edge AI tools can hold conversations just like a real person.

This lets them understand your questions and requests, whether it’s checking your balance, transferring money, or even getting personalized financial advice.

They also use machine learning to continuously improve and become more helpful over time. Basically, financial chatbots are here to make banking faster, easier, and more convenient for everyone.

The Benefits of Chatbots in Banking and Finance

- Uninterrupted Accessibility: Financial chatbot ensure that banking services are accessible 24/7, providing unmatched convenience to customers.

- Customized Banking Experiences: Leveraging data analytics, chatbots in banking can offer personalized recommendations and insights, enriching the customer journey.

- Operational Efficiency: Financial chatbots excel in managing routine banking tasks promptly and accurately, boosting operational productivity.

- Cost Reduction: The automation capabilities of financial chatbots leads to significant savings in banking operational costs.

- Robust Security: Financial chatbots play a crucial role in monitoring transactions and detecting fraudulent activities, safeguarding the banking ecosystem

The Expanding Role of Chatbots in Banking

- Immediate Customer Assistance: Financial chatbots provide swift responses to queries regarding account details, transaction history, and more, minimizing the need for in-branch visits or long phone waits.

- Tailored Financial Guidance: Chatbots in banking analyze user data to deliver personalized investment advice, budgeting strategies, and help customers achieve their financial aspirations.

- Streamlined Transaction Processing: Financial chatbots facilitate a variety of banking transactions, making the process more user-friendly and efficient.

- Proactive Fraud Detection: Financial chatbots actively scrutinize account activities for any irregular patterns, promptly notifying users and banks of potential security threats.

- Effortless Customer Onboarding: Chatbots in banking simplify the account registration process, efficiently gathering and verifying user information.

- Up-to-Date Market Insights: Financial chatbots provide users with current financial news, market trends, and investment opportunities, supporting informed decision-making.

- Convenient Appointment Scheduling: Financial chatbots can efficiently arrange meetings with financial advisors or bank representatives, ensuring a seamless customer experience.

- Insightful Feedback Collection: Financial chatbots collect user feedback on banking services and products, offering valuable insights for service enhancement.

- Strategic Cross-Selling and Upselling: Financial chatbots identify opportunities to introduce users to additional banking products and services that align with their needs.

- Regulatory Compliance Support: Financial chatbots assist users in understanding regulatory requirements and help banks maintain compliance with industry standards.

Factors to Consider while implementing financial chatbots

- Select the Appropriate Platform: Choose a chatbot platform that is compatible with your banking systems and prioritizes data security.

- Define Specific Objectives: Determine the precise goals you want your financial chatbot to achieve, such as enhancing customer service or facilitating transactions.

- Design Intuitive Conversational Flows: Create a natural and user-friendly chat flow that guides users through various banking tasks and inquiries.

- Ensure Data Security: Implement stringent security measures to protect customer data and comply with financial regulations.

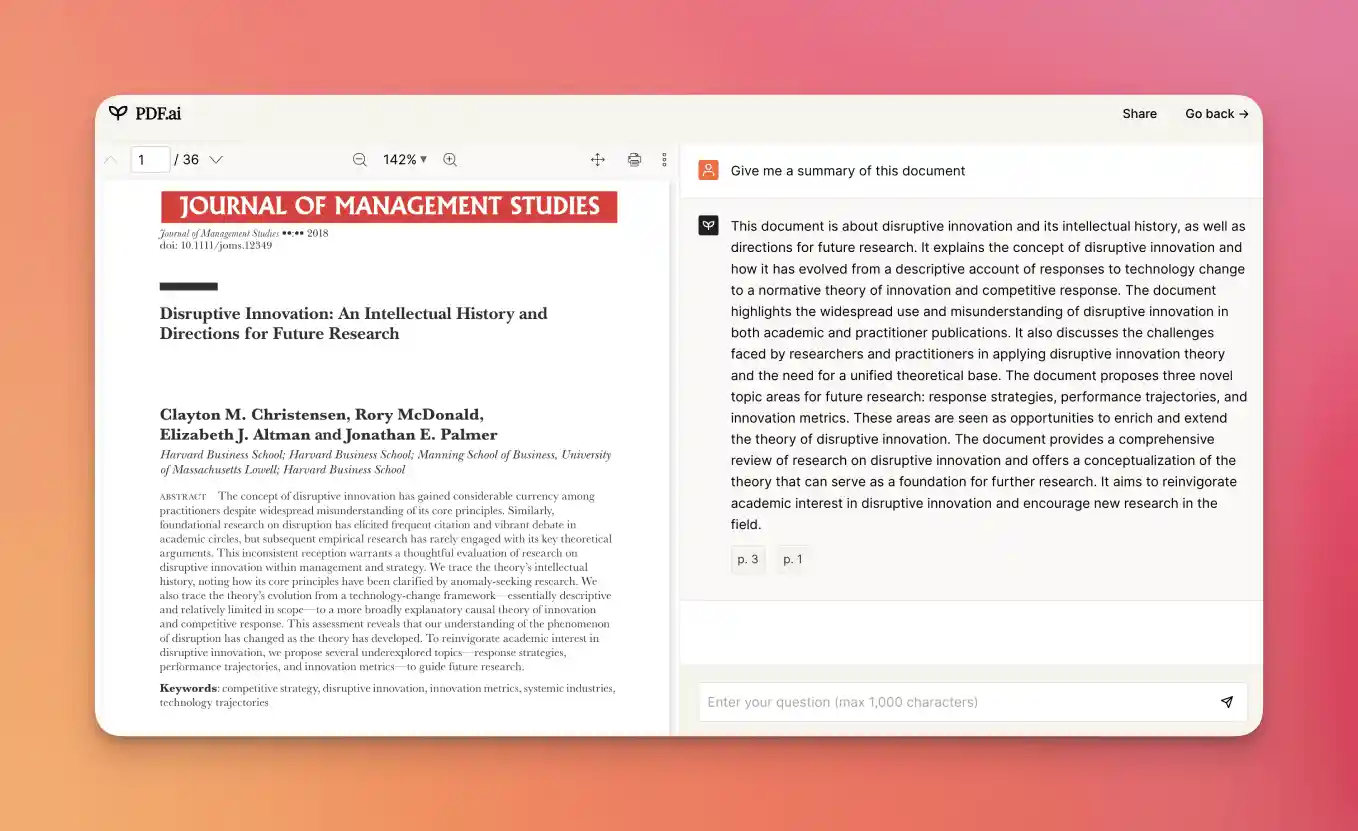

- Train Your Financial Chatbot: Utilize historical customer interactions and banking data to refine your chatbot’s ability to handle diverse queries.

- Conduct Comprehensive Testing: Ensure your financial chatbot functions correctly in various scenarios and delivers a positive user experience.

- Deploy and Iterate: Launch your financial chatbot on your website, monitor its performance, and continuously refine its capabilities based on user feedback.

The Future Outlook for Financial Chatbots

Get ready for smarter chatbots! The future holds:

- Super-understanding chatbots: They’ll grasp even tricky questions and slang.

- Emotionally aware chatbots: They’ll adjust their tone based on your mood (frustrated? they’ll be extra helpful!).

- All-in-one chatbots: They’ll connect to more tools, letting you do things like transfer money or check investments, all in one chat.

- Proactive chatbots: They’ll look out for you, suggesting ways to save or warning you about suspicious activity.

Basically, chatbots are getting smarter and more helpful, making banking a breeze.

Conclusion

Financial chatbots are transforming the banking industry, offering a blend of efficiency, personalization, and accessibility. As financial institutions increasingly adopt this technology, customers can anticipate a future with financial chatbots like Chatmason where managing finances is not only simpler but also more secure and engaging. The proliferation of chatbots in banking underscores the transformative power of AI in reshaping the financial landscape.